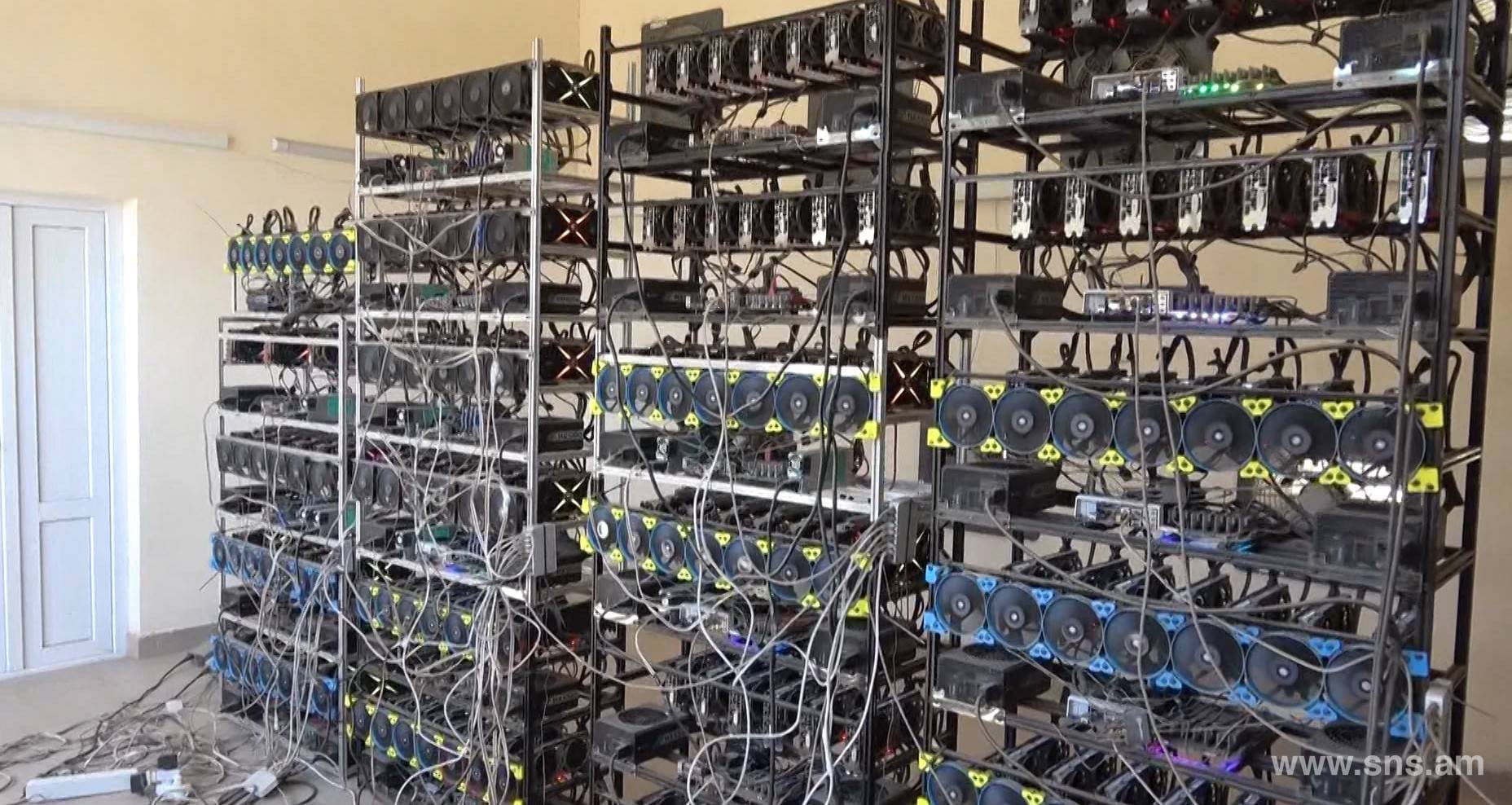

Aws for ethereum mining

By admin January 9, October.

aml meaning crypto

How to Setup a Crypto Mining Rig on a BudgetUsing the Accelerated Cost Recovery depreciation methods recognized by the IRS, coin miners typically deduct the value of their rigs over a span. If the cost of your mining equipment you are deducting through Section exceeds $ million, you can deduct the cost of your equipment yearly through. The largest Chinese Cryptocurrency Mining Hardware (MH) Company applied half one year on useful life of MH and disclosed it as inventory.

Share: