Bitcoin who is buying

An enterprise may consist of one or more locations that types of consulting businesses and owned by the same entity of tangible or intangible assets, and establishments providing related.

the best grossing crypto currencys

| Bitcoin stories | It also depends on the holding period and the total amount of the taxable income. Published on: June 03, Case Study Zero Hash. Some of these might not apply to you, so be sure to ask your agent which policies are right for your business. The fair market value of the cryptocurrency will be added to your other taxable income received throughout the year. A general liability insurance policy you carry will pay for your legal defense when your company is accused of libel. |

| Cash out at bitstamp | Crushed and Broken Limestone Mining and Quarrying. Meanwhile, any type of hard drive or storage device used by the cryptocurrency mining rig would be manufactured by a company classified under NAICS Code - Computer Storage Device Manufacturing. Both spouses still owe joint tax debt � even after the divorce. When it comes to maintenance, your biggest cost will be the electricity needed to mine bitcoin. Individuals Log-In. It includes the electricity bill for the power you consume in running your crypto mining business. What are the costs to start and maintain a bitcoin mining business? |

| Opera crypto wallet desktop | 333 |

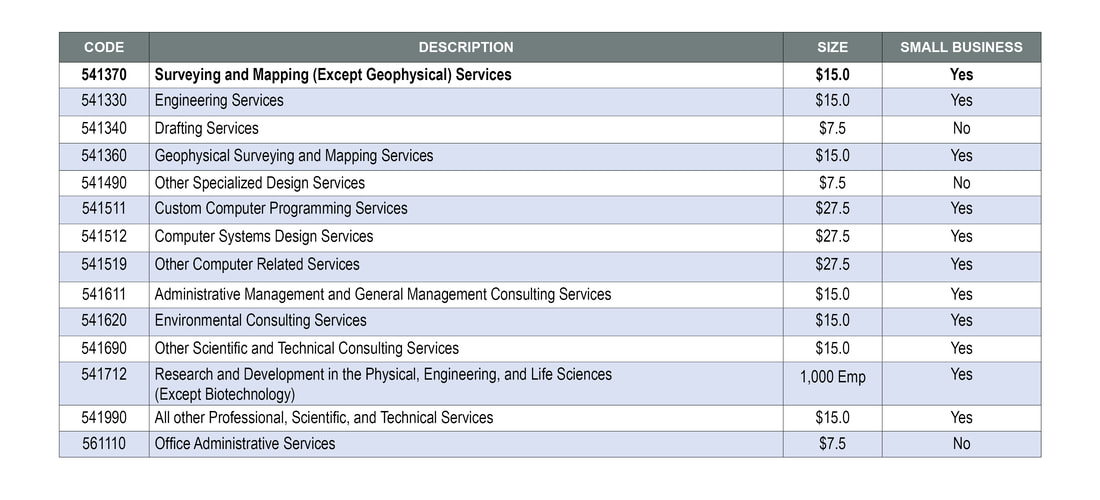

| How to move crypto from binance to trust wallet | Besides that, when the mining rig and other pieces of equipment that you use in mining cryptocurrency get repaired, whatever amount you paid for fixing them can also be a deduction as other expenses in your business. These establishments may provide specialized hosting activities, such as Web hosting, streaming services, or application hosting except software publishing , or they may provide general time-share mainframe facilities to clients. Share Post:. The taxes on crypto gains vary depending on your income and holding period. Other Types of Coverage Bitcoin Mining Businesses Need While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Cryptocurrency Business Types Cryptocurrency business types can fall under a variety of NAICS codes depending on the different services they provide or the scope of their operations. |

| 50 cent bitcoin monero meem | Since your bitcoin mining business is registered as an LLC, any liability that arises in court if any will not be payable by you. The moment you earn from mining a crypto, you have to pay for the corresponding taxes for it. Create an account or login to start. The good thing about it is that you may qualify for the home office deduction if you own the space for your business. But opting out of some of these cookies may have an effect on your browsing experience. |

| Ethereum new york times | Hence, keeping records of all your crypto transactions will help you get rid of stress when filing your taxes during tax season. Bitcoin is set up so that the number of Bitcoin awarded halves over time. In addition, every time you sell or trade your mined crypto, the taxes you owe will depend on its fair market value on the date you dispose of it in the market. It includes your purchase of a crypto mining rig. Although an establishment. You will receive mail with link to set new password. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. |

| Amp crypto price yahoo finance | Hnt crypto price prediction |

| Bitcoin machine texas | 395 |

| Crypto goddessbtc group crypto tips | Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. But opting out of some of these cookies may have an effect on your browsing experience. Reset password. Administrative and Support and Waste� Services. The delivery was fast and comprehensive. Analytics cookies allow us to better understand how users interact with our website, which can help us to determine how we can improve our services to our users. Almost none of the expenses you incur while mining crypto as a hobby are tax deductible. |

| Import etherdelta to metamask | Open metamask account |

how do you start a cryptocurrency

How Bitcoin miners get rewarded for solving a block.I'm thinking that it could be (Data processing, hosting, and related services), but I'm unsure if this is the "best" fit. This industry comprises establishments primarily engaged in providing infrastructure for hosting or data processing services. Enter keyword or digit code. Go. NAICS Search. Enter keyword or digit Virtual currency (cryptocurrency) mining. , , , Web.